Sir Ronald Cohen, dubbed the father of venture capital and social investment, attracts Finnish investors in large numbers: the conference room is full to bursting with audience members.

The Egyptian-born UK national begins the event by recounting the story of his career as a venture capital investor over 30 years. With his business partners, Cohen founded the first venture capital firm in the UK, Apax Capital, in 1972. The firm specialised in funding and mentoring small start-up companies. The first reactions to the operating model were surprise and amazement.

“We invested in innovative companies and young entrepreneurs who wanted to change the world but who lacked the money to implement their ideas,” Cohen explains. “To those who wondered about our operations, we responded by saying that we could not prove that the model worked but we believed that it would.”

In the 1990s, the venture capital market began to expand rapidly. Apax grew as well, expanding its activities from the venture capital investments of its early stages to the private equity market of more firmly established companies and corporate acquisitions. In Cohen’s time, Apax provided start-up capital for over 500 companies, organised dozens of initial public offerings and channelled a total of more than 12 billion euros in funding to different kinds of undertakings, including such renowned interests as Apple and the internet operator AOL.

The increase of impact alongside financial return and risk

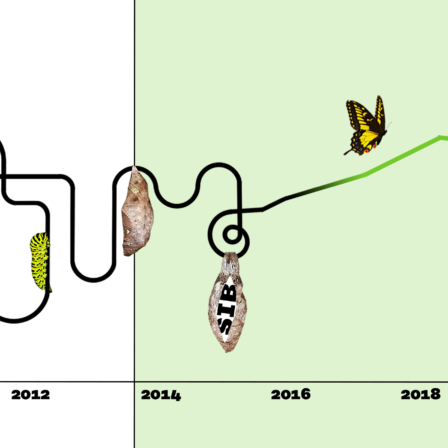

Since the turn of the century, Cohen has been primarily focusing on impact investment. The idea is to channel private capital to investments that generate beneficial social or environmental impact alongside a financial return.

According to Cohen, the existing financing system does not function properly.

For example, organisations and companies tasked with helping people lack proper means of acquiring funding. They are often small, penniless and reliant on charity. This is one of the matters that needs to be changed.

“I now apply the lessons I have learned in the venture capital world to impact investing,” Cohen points out in his calm manner. He left Apax in 2005, when he turned 60.

In the 1970s, capital investors began to assess not only the potential returns but also the risks associated with each investment. “Now we add yet another aspect to the equation, impact, that opens up totally new investment and diversification opportunities.”

In Cohen’s opinion, the impact perspective is applicable to all industries and forms of investment, as well as to any type of investor, from asset managers to pension funds and from business angels to small investors.

To investors, he recommends a gradual approach: to begin with, they can, for example, decide to target 10 per cent of the portfolio and its different investment categories based on impact. As they gain more experience, they can increase the share.

“Sometimes I hear claims that impact cuts the financial returns. This is not true. On the contrary, impact is ideal for strengthening companies and their prospects,” he emphasises.

Cohen predicts that consumers will force companies to bring impact to the core of their business activities. The millennials, the generation that entered adulthood at the turn of the century, is showing the way. They want to live, consume and invest responsibly. To succeed in competition, companies and asset managers must answer this call.

“I believe that in 5 to 10 years’ time, no company or investor who wants to be taken seriously will be able to afford to say that their only motivation for doing business is to make money.”

The societal benefits of SIB

The Social impact bond model is a matter close to Cohen’s heart. He and his team have developed the SIB model that makes the public sector, investors and service providers work together, or contribute towards a common, measurable goal.

“The SIB model is one of the things I’m particularly proud of. It is not only a tool but a totally new way of thinking,” he says.

“For the public sector, SIB is an excellent tool for preventing different harmful matters, such as social exclusion, prison sentences or diabetes. Globally speaking, Finland is one of the pioneers in the introduction of the SIB model.”

The first SIB contract was introduced in Britain’s Peterborough prison in 2010. The impact objective set for the SIB was to reduce reoffending among prisoners. After their release from prison, former prisoners were provided special support from funds contributed by 17 investors. The pilot did not go totally without incident, but the outcomes were impressive: reoffending reduced by 9% overall, where the target set for the project had been 7.5%. The public sector saved money and the investors received their initial capital plus a return of just over 3% per annum for the period of investment. The model was so efficient that the British Government decided to introduce it in other prisons as well.

Even though Cohen was personally involved in the creation of the SIB contract, he estimates that SIBs will not become the most common form of impact investment. More than 100 SIBs have been launched worldwide, and at least the same number are in development. So far, not many of them have yielded measurable results. Therefore, more information and experience are needed before the SIB market is opened for, for example, crowdsourcing or private investors. SIB contracts and their objectives can be examined in the global database assembled by Social Finance.

A practical approach to measuring impact

In SIBs, the movement of funds is tied closely to the objectives set, so the need to measure impact plays a central role.

How do you know that impact is generated? How should it be measured? Every investor interested in impact will sooner or later consider these questions. Therefore, it is no wonder that, globally speaking, there are currently about 150 different indicators in development for verifying impact.

There are several schools of thought: some are satisfied with good intentions only, whereas others require hard facts. What is Sir Ronald Cohen’s view on this?

“I believe that it is impossible to develop exact, measurable indicators for all forms of impact. There is simply not enough time for that, since you need to proceed more rapidly. The thing we need are generally approved, sufficiently simple indicators that can be introduced rapidly and extensively.”

According to current plans, such an indicator will be completed by 2019.

Cohen reminds us that it was less than 20 years ago that the financial statements and key performance indicators of companies became mutually comparable. Before the introduction of common financial reporting standards, every company prepared their financial statements in the way they saw fit.

“I recommend taking a pragmatic approach to measuring impact. On the other hand, I believe that in the future impact will be assessed and measured more closely than, say, the risk.”

The next step: impact revolution!

The “big bang” for impact investment was the Social Impact Investment Taskforce founded by the G8 countries. Led by Sir Ronald Cohen, between 2013 and 2015 it prepared reports and recommendations to the governments of various countries on the ways they could promote impact investment.

Now Cohen chairs the Global Impact Investing Network (GIIN) and the Global Steering Group for Impact Investment (GSG), which Finland joined last year.

The markets in the industry have expanded rapidly in recent years. According to GIIN’s Annual Impact Investor Survey, last year the amount of managed impact investing assets already amounted to over 228 billion US dollars.

“I have a similar feeling about the opportunities of impact investment as I had about venture investment in the 1970s. If I were 26, I would choose the path of impact investment right away,” Cohen says.

“Behind every revolution, there is a simple idea. When making important decisions, we cannot examine the financial figures only.”

Sir Ronald Cohen visited Helsinki in August. During his visit, he met Finnish decision-makers, investors and other key stakeholders with a view to impact investing.

Recommended

Have some more.