IMPACT INVESTING

Impact investing helps promote well-being effectively and in a resource-wise way. It is a means of channelling private equity to projects whose aim is to achieve positive, measurable social benefit.

(project has ended at Sitra)

WHAT IS IT ABOUT?

Find out.

The project has ended at Sitra. From 2020 to 2021, The Centre of Expertise for Impact Investing carried on with the development work at the Ministry of Economic Affairs and Employment. In 2022, The Centre was transferred to Motiva.

Impact investing is a means of enhancing profitable co-operation between the private, public and third sectors by preventing and solving various well-being and environmental problems. Only approximately a tenth of all social welfare and healthcare funds are channelled toward preventive measures, even though these would be far more economical over the long term than solving problems. Hip fractures and type 2 diabetes are examples of medical conditions that cause significant problems for people and are usually preventable. Impact investing offers a way to make carefully planned, long-term, front-loaded investments.

What did we do?

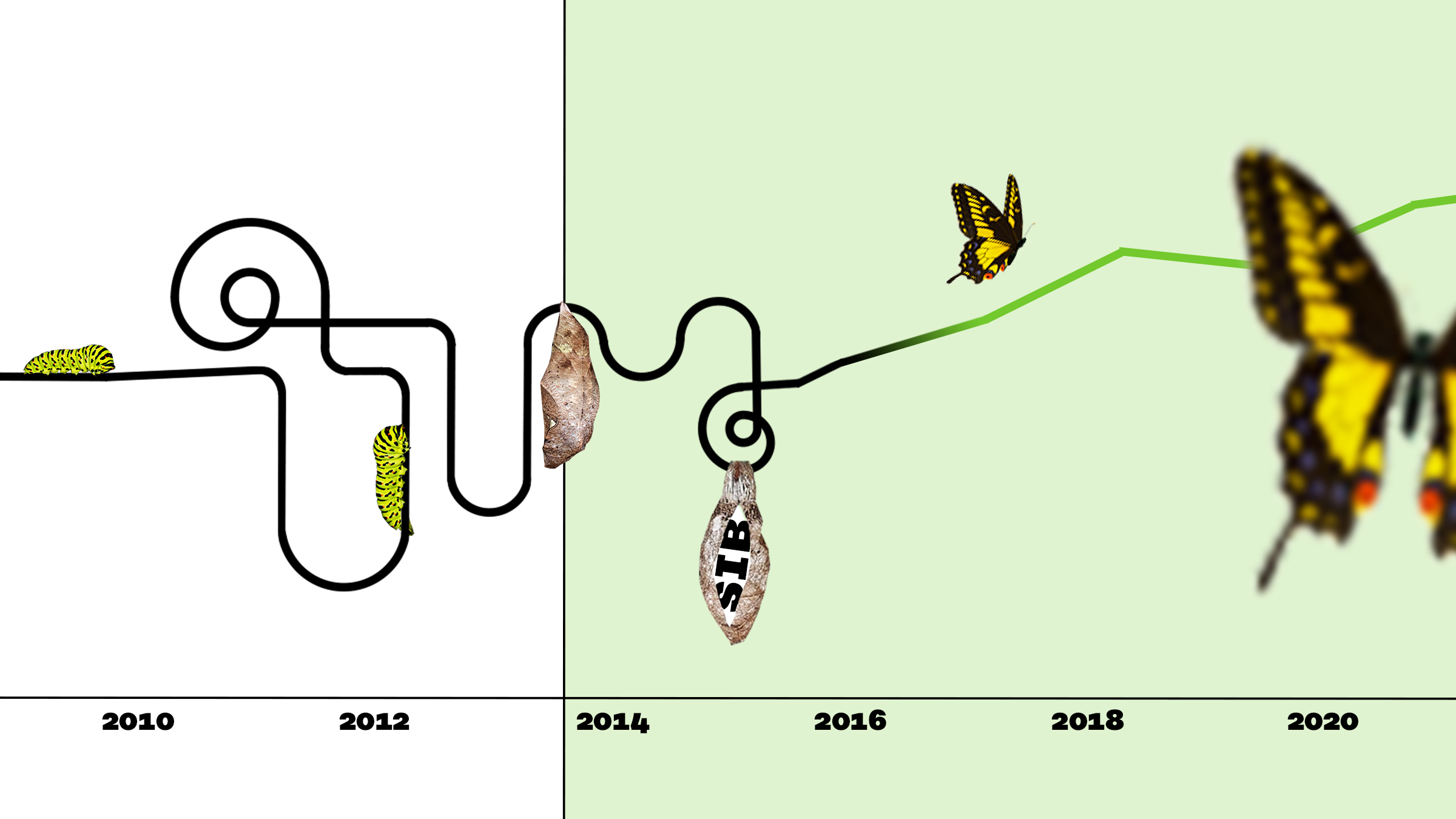

The goal of Sitra’s Impact Investing team was to import this new model to Finland: to build the necessary ecosystem for it, encourage various stakeholders – the public sector, service providers and investors – to join and test the effectiveness of the model in Finnish society.

Who participates?

In the current economic situation, central government and local and regional authorities need new tools for promoting and financing well-being. An increasing number of investors want more than just returns on their investments – they want to promote the common good. There are also companies and organisations that have innovative solutions for promoting well-being and a desire to establish the effectiveness of their operations. Impact investing brings these companies and organisations together in a way that benefits everyone.

Where are we?

At the end of 2019, a total of six social impact bonds and one environmental impact bond (EIB) are up and running or under construction in Finland. There is, gratifyingly, a great deal of interest in these agreements from the public sector and among companies, organisations and investors.

Where are we now?

Sitra’s project has ended. The development of impact investing continues at Motiva.