Responsible investing at Sitra

Sitra invests its assets responsibly, while aiming for a profit. For Sitra, responsible investing means taking account not only of the return and risk but also of the environmental, social and governance (ESG) factors in all investment decisions. The UN Principles for Responsible Investment (PRI) serve as instructions and guidelines in this respect, with Sitra having made a commitment to the PRI in 2015. Alongside the PRI, the Global Compact principles are another internationally recognised framework for responsible investing, which Sitra also adheres to.

When investing responsibly, we follow the Guidelines for Responsible Investment approved by Sitra’s Board of Directors. Sitra’s annual investment strategy also addresses responsibility-related issues and establishes guidelines for future development efforts.

Sitra’s investments are mainly made through funds. Fund investments include all equity funds, fixed income funds, index funds and private equity funds. They are managed by external asset managers who make individual investment analyses and investment decisions. Sitra’s investments also include a few direct investments.

Responsible investing involves taking the particular characteristics of each asset class into consideration. Responsibility is reflected in the selection and monitoring of all investments and is subject to continuous assessment and development.

In 2021, the most significant milestones for Sitra in the area of responsible investing were drafting a climate policy, setting a carbon neutrality target and the adoption of climate reporting. With climate reporting, we apply the TCFD (Task Force on Climate-Related Financial Disclosures) framework.

We also updated our Guidelines for Responsible Investment with regard to the acceptable domiciles of funds, and we carried out an ESG survey of our asset managers.

All of the members of Sitra’s investment team completed ESG training provided by the PRI Academy in 2021.

Sitra has been a member of Finland’s Sustainable Investment Forum, Finsif, since 2013. We are actively involved in the forum’s board work and the organisation of events, among other things.

Guidelines for Responsible Investment

Responsible investing at Sitra is shaped by the Guidelines for Responsible Investment, approved by Sitra’s Board of Directors. The guidelines were most recently updated in spring 2021, at which time we specified our policy concerning the acceptable domiciles of funds and published Sitra’s climate strategy for investments.

According to the guidelines, the following are excluded from all of Sitra’s investments:

1) manufacturers of tobacco products if the tobacco products account for more than 50% of turnover;

2) companies manufacturing controversial weapons;

3) companies with more than 30% of their turnover linked to coal production or coal use in power generation without a clear strategy to reduce coal use;

4) companies that have violated internationally accepted norms (concerning human rights, the environment, corruption and working conditions) and have not done enough to change their ways.

Sitra always identifies the domiciles of the registered offices of funds considered for investment. The Guidelines for Responsible Investment have been updated with regard to acceptable domiciles for fund investments. Sitra cannot invest in funds that are registered in tax havens. In future, Sitra will use the following country lists maintained by international institutions (EU, OECD) to define tax havens:

- the EU common list of non-cooperative tax jurisdictions (“the EU blacklist”);

- states that do not participate in the automatic exchange of tax information in compliance with the OECD Common Reporting Standard (CRS) or the Foreign Account Tax Compliance Act (FATCA);

- states that do not comply with the requirements of the OECD’s Global Forum on Transparency and Exchange of Information for Tax Purposes.

Reporting

A reporting reform was implemented in the period 2020-2021 in collaboration with Investment Research Finland to enable a better assessment of the climate risks of Sitra’s investments. In 2021, reporting co-operation was expanded to also include the reporting of climate risks, by the finance and analysis company MSCI, in addition to the previous fund-specific ESG reports. For the time being, the scope of reporting covers listed equity funds, fixed income funds and real estate funds.

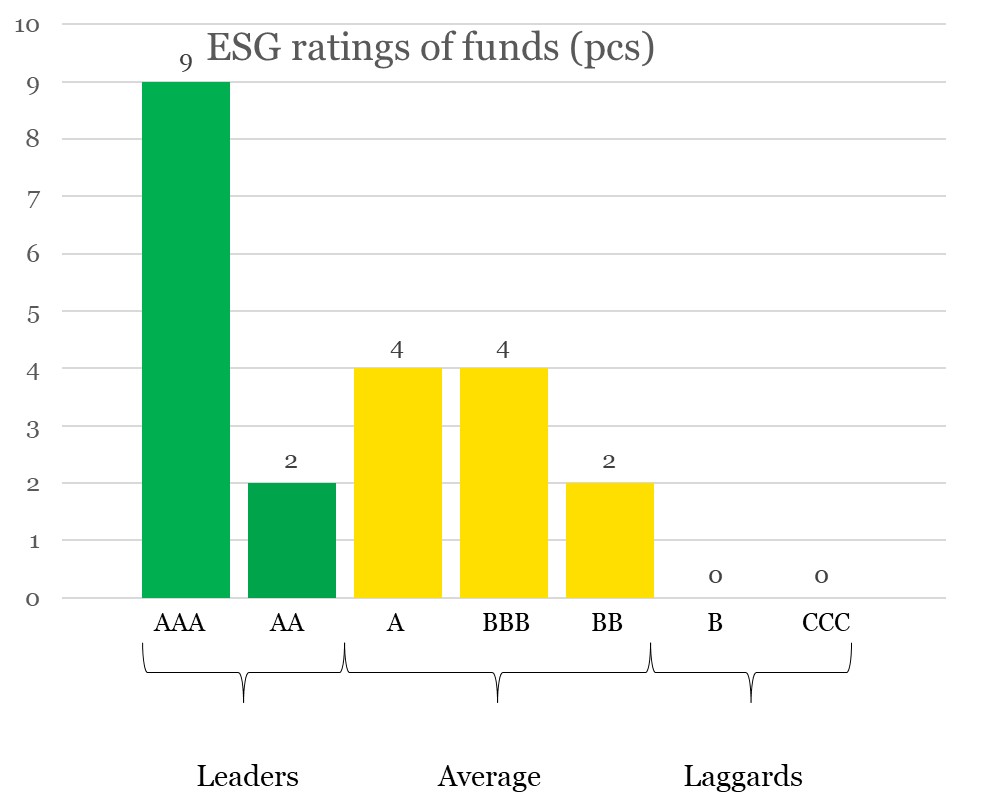

The ESG ratings of the funds covered improved from last year and were at a fairly good level. MSCI’s ESG ratings range from AAA to CCC, much like credit ratings. Nine funds were upgraded to the highest rating of AAA, whereas a year earlier there were no AAA-rated funds. More than half of the funds are rated as so called ESG “leaders”. Ten of the funds are rated average and there are no “laggards” among Sitra’s fund investments. Measured in terms of the value of investment, the share of leaders is even higher, at approximately two thirds. The rating of Sitra’s listed investment portfolio as a whole rose from A to AA.

Source: MSCI

The development of reporting will also continue with regard to responsibility. As a signatory to the PRI and a public supporter of TCFD it is required that investments are adequately evaluated and selected key indicators are monitored. A report on responsible investment is submitted to the PRI annually.

The PRI revised its reporting framework in 2021, resulting in a delay in the PRI’s assessment of Sitra’s reporting for 2021. The assessment will be issued in autumn 2022. In the previous PRI report, for the year 2020, Sitra was awarded a rating of A+ for strategy (2019: A), a rating of A for selection and monitoring of asset managers (2019: B) and a rating of C for active ownership (2019: D). PRI reporting is one tool for improving responsible investment practices by benchmarking the organisation’s actions against the best practices in the sector.

Engagement efforts

As a fund investor, Sitra has the opportunity to engage in dialogue with asset managers and influence its investments. If engagement efforts do not lead to improvement, the fund in question may, as a last resort, be sold. In 2021, ESG issues were discussed in approximately 80% of the meetings held.

Screening of industries and for potential norm violations was carried out in spring 2021, based on the MSCI reporting. There was no need for further action following discussions with the asset managers. Exclusions were carried out in accordance with Sitra’s Guidelines for Responsible Investment.

Funds categorised as alternative investments (real estate, infrastructure, private debt, Private Equity and Venture Capital) were reviewed in the valuation meeting in 2021, using reports provided by the asset managers to assess the funds’ key ESG issues. Observed deficiencies and breaches were reported and noted in the minutes of the meeting for follow-up. No deviations from Sitra’s industry exclusions were observed. The lack of data, particularly in the private equity and venture capital asset classes, constitutes a challenge with regard to the in-depth assessment of ESG issues. The asset managers are aware of these deficiencies and significant improvements in reporting are expected.

In addition to discussions with asset managers, Sitra’s engagement efforts include participation in investor initiatives, such as the Climate Action 100+ project. Sitra aims to continue to participate in other relevant initiatives that support Sitra’s investment strategy and sustainability goals. In addition to taking environmental issues into account, addressing social responsibility and governance issues is also important in investment activities.

ESG survey for asset managers

In summer 2021, Sitra conducted an ESG survey among all fund managers managing Sitra’s funds. The aim was to obtain information on responsible investment processes and their significance to the operations of each fund. The last survey before 2021 was conducted in autumn 2018. The 2021 survey was sent out to 96 funds, and the response rate was 93% (2018: 69%). The significant increase in the response rate can be seen as reflecting the development of ESG processes and, in general, the mainstreaming of ESG issues in the investment market.

One important aspect of the ESG survey was to ensure that Sitra’s investments are aligned with Sitra’s Guidelines for Responsible Investment. The minimum requirement for fund investments is that the asset manager has signed the PRI or abides by some other operating model with regard to responsible investing. Among those that responded to the survey, only five funds did not have a responsible investment policy or similar guidelines, but those five funds also indicated that they were in the process of drafting such a policy and/or guidelines.

All asset managers managing listed equity funds, fixed income funds, real estate funds, forest funds and infrastructure funds have signed the PRI principles. For other investments, 68% have signed the principles. The other investments include non-liquid investments where the asset managers are often smaller, local operators. The lowest level of PRI compliance was in the venture capital fund category, where only 12% had made an official commitment to the Principles for Responsible Investment. This divergence is partly due to the resources at the asset managers’ disposal. Nevertheless, even among the funds that are not signatories to the PRI, most take the principles into account in their operating practices. All in all, asset managers that are PRI signatories manage 92% of the total value of Sitra’s investments.

Many funds that manage Sitra’s assets are also involved in other initiatives aimed at promoting responsible investment. For example, 14 funds participate in the Global Real Estate Sustainability Benchmark (GRESB), which is a global tool and framework used for assessing the sustainability of real estate, infrastructure and investment assets. Five funds also reported using the Building Research Establishment Environmental Assessment Method (BREEAM) environmental classification system concerning construction. BREEAM is based on a common set of European standards.

Over 90% of the funds that responded to the survey indicated that they provide ESG training. While the largest organisations have in-house teams providing internal ESG training, most of the respondents rely on external seminars and training services. The target groups of these training activities ranged from management teams to investment teams and administrative bodies.

Approximately 60% of the funds had sustainability targets, but only 40% had established direct incentives for their achievement. Consequently, there was a lack of a clear link between remuneration and strong performance in responsible investment. Many of the respondents indicated that ESG issues were part of remuneration, but the weight assigned to ESG issues was left unclear.

ESG issues are integrated into asset managers’ investment processes. Three out of four respondents indicated having rejected potential investments as a result of ESG considerations. The reasons behind the rejection of potential investments included environmental risks, reputation risks, the unethical treatment of workers and non-compliance with the UN Global Compact in general. Nine funds reported negative ESG incidents during the life cycle of their funds. The companies in question had taken action in response to each of these incidents and implemented corrective measures, such as improvements to occupational safety.

Climate strategies were still relatively uncommon in 2021. Only five of the funds had carbon neutrality targets: one was pursuing carbon neutrality by 2040, two by 2030 and two by 2050. However, a third of the funds indicated that they already report on their climate risks in accordance with the TCFD framework. Five funds also report the share of climate-positive companies.

Assessment of biodiversity issues in the context of investments was still uncommon, although approximately a third of the respondents had analysed the impacts of biodiversity loss on their investment activities, and roughly a quarter of the respondents had analysed the impacts of investments on biodiversity loss. This is a clearly identified area of development, but the availability of data is a challenge. Furthermore, not all of the surveyed funds saw the assessment of biodiversity perspectives as a relevant issue.

More than half of the funds that responded to the survey indicated that ESG issues are very important factors in decision-making. Only one of the respondents stated that such issues are not significant. The methods of responsible investing that the surveyed funds used were exclusion (70%) and positive screening (51%). Nearly all of the surveyed asset managers (92%) also exercise active ownership and engagement (92%).

Climate strategy

Mitigating climate change is one of Sitra’s most important sustainability goals. Low-carbon solutions and sustainable development are also guiding principles for our investment activities, which means that we support the goals of the Paris Agreement. This is also directly related to Sitra’s strategic goal of adaptation to the earth’s carrying capacity.

To make this more concrete, Sitra’s climate strategy for investments was published in spring 2021. The long-term objective is that all of Sitra’s investments are aligned with the Paris Agreement. The aim is to achieve a carbon-neutral investment portfolio by 2035 in accordance with Finland’s national target, provided that the investment environment makes it possible.

The climate strategy is used for managing climate risks associated with investments and for trying to identify future profit opportunities. Assessing climate risks is clearer for equity investments and corporate bond investments than for alternative investments, for example, where the more limited availability of data is a challenge. The climate risks of Sitra’s investments are evaluated to the extent that information is available.

Sitra applies the TCFD framework in the reporting and analysis of climate risks. The TCFD is an international reporting recommendation that instructs companies to report consistently on the financial risks and opportunities presented by climate change. Examples of the areas of assessment outlined in the recommendation include the carbon footprint of investments, fossil fuel reserves, low-carbon investments, high-carbon investments and alignment with the carbon emission limits set out in international climate agreements.

The carbon risk associated with investments is primarily measured in terms of weighted carbon intensity. This means measuring the carbon-equivalent emissions of investees relative to their turnover and weighted by the market value of the investments. For the time being, the reported indicator only includes the Scope 1 and Scope 2 emissions of the companies invested in. Scope 1 refers to the emissions arising directly from their operations, while Scope 2 refers to the emissions of purchased electricity. Assessing indirect Scope 3 emissions is more challenging and reliable data is not yet available.

Carbon risk calculation currently covers listed equity, fixed income and real estate investments. Adequate data is not yet available for the other asset classes.

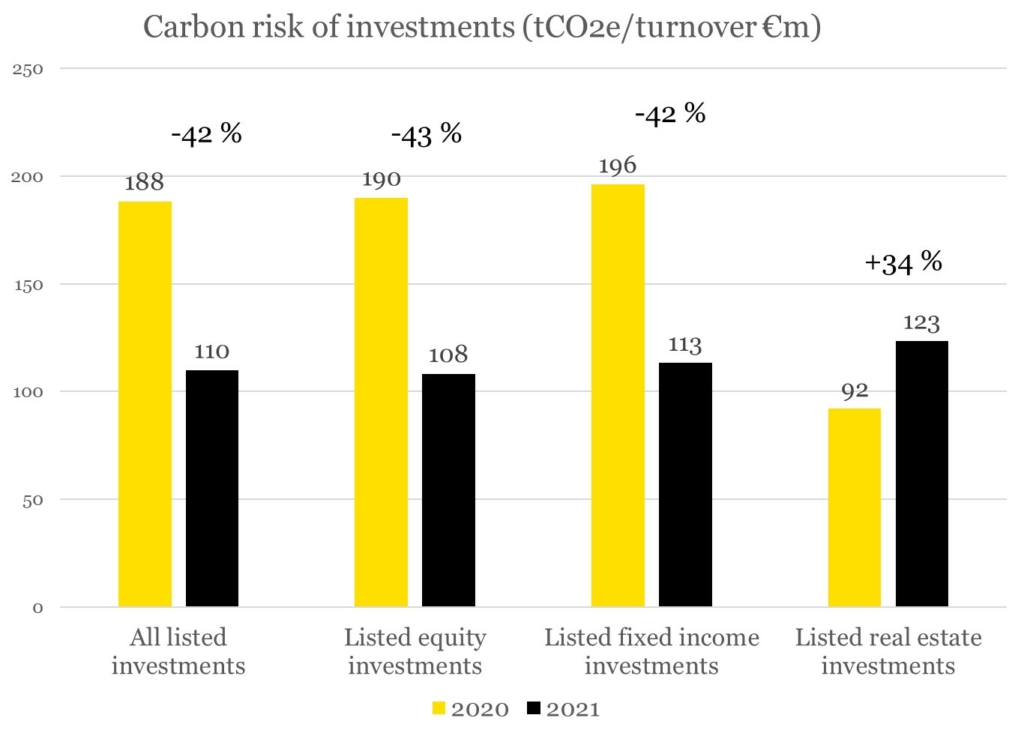

Calculated in this manner, at the end of 2021, the weighted carbon intensity of Sitra’s entire investment portfolio was 110 tCO2e/€m in turnover. Equity investments had a carbon intensity of 108 and fixed income investments 113. The weighted carbon intensity of the investment portfolio decreased by over 40% compared to 2020. The carbon intensity decreased in 80% of the funds within the scope of monitoring. For listed real estate investments, the weighted carbon intensity increased as a result of one of the two REIT (Real Estate Investment Trust) funds merging with a global index fund.

Source: MSCI

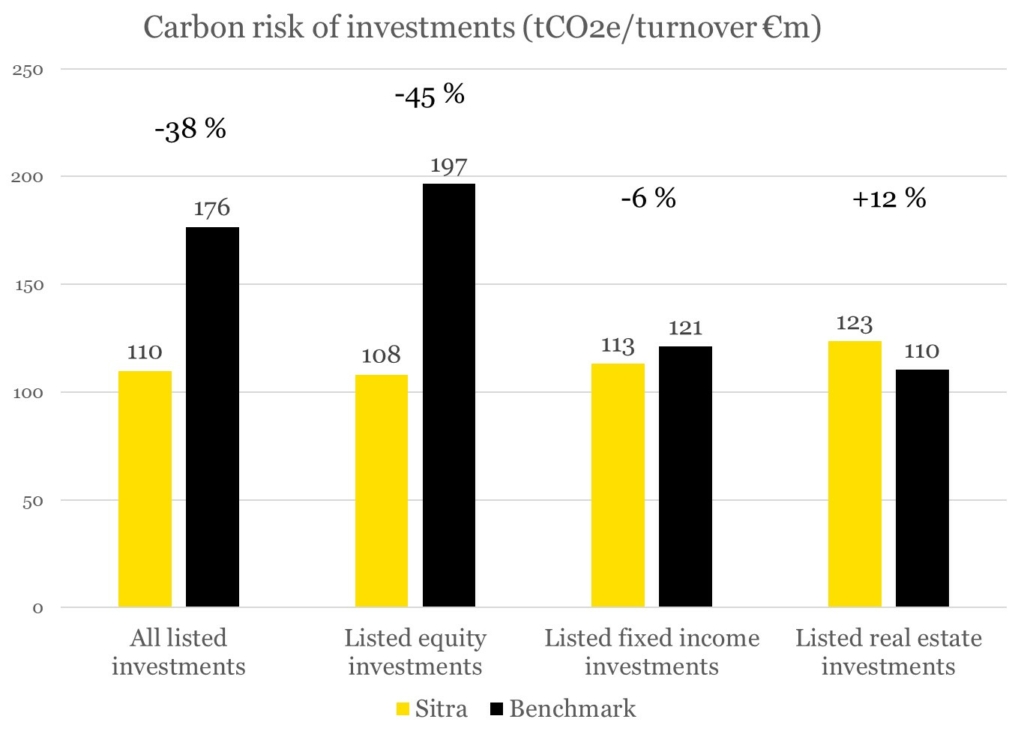

The carbon risk of Sitra’s investments is also compared with a benchmark index that consists of equity and fixed income indices weighted according to the relative shares of the corresponding funds in Sitra’s portfolio. The carbon risk of all of Sitra’s listed investments was nearly 40% lower than that of the benchmark index. This difference is attributable to exclusions, the selection of responsible asset managers and the fact that Sitra’s equity investments are focused on growth stocks. The carbon risk of Sitra’s listed real estate investments was slightly higher than that of the benchmark indices, which was mainly due to the aforementioned merger between funds.

Source: MSCI

The figures reflect the companies’ Scope 1 and Scope 2 emissions based on fund holdings on 31 December 2021. The benchmark index is a combination of weighted indices. The indices used were MSCI ACWI, MSCI Finland IMI, MSCI Europe, MSCI Emerging Markets, MSCI EUR IG Corporate Bond, MSCI EUR HY Corporate Bond and MSCI World Real Estate. The carbon risk of investments is also assessed in terms of exposure to fossil fuels. The amount of such investments is already very low in Sitra’s portfolio.

The analysis and reporting of climate risks still involves challenges linked to the reliability, comparability and scope of data, for example. This has made it more difficult to set detailed targets.

The need to take account of biodiversity has emerged as an important issue in investment activities over the past few years. Developments around that theme are still in their early stages, but there are various initiatives and activities under way. One of the most prominent and credible projects is the Taskforce on Nature-related Financial Disclosures (TNFD), which aims to create a reporting framework for taking account of biodiversity that corresponds to the use of the TCFD framework in the context of climate change. The final recommendations will be provisionally published in autumn 2023. We are actively monitoring these developments with the aim of reporting in accordance with the TNFD framework in the future.

Disclaimer: Although Sitra’s information providers, including without limitation, MSCI ESG Research LLC and its affiliates (the ”ESG Parties”), obtain information (the ”Information”) from sources they consider reliable, none of the ESG parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for, or a component of, any financial instruments or products or indices. Further, none of the Information can in and of itself be used to determine which securities to buy or sell or when to buy or sell them. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Recommended

Have some more.