Responsibility in Sitra’s investment activities

Sitra invests its assets responsibly while aiming for profit. For Sitra, responsible investing means taking account not only of the return and risk but also of the environmental, social and governance (ESG) factors when making investment decisions.

The UN Principles for Responsible Investment (PRI) serve as instructions and guidelines for Sitra’s responsible investment activities. Sitra made a commitment to the PRI in 2015. Alongside the PRI, the UN Global Compact principles serve as another internationally recognised framework for responsible investing.

The practical implementation of the activities is based on the Guidelines for Responsible Investment approved by Sitra’s Board of Directors, which was last updated in 2022. The key updates were related to the selection criteria of asset managers, the measures taken when investments are not in line with the established guidelines, and the monitoring of asset managers’ engagement and ownership practices.

Funds and responsible investment

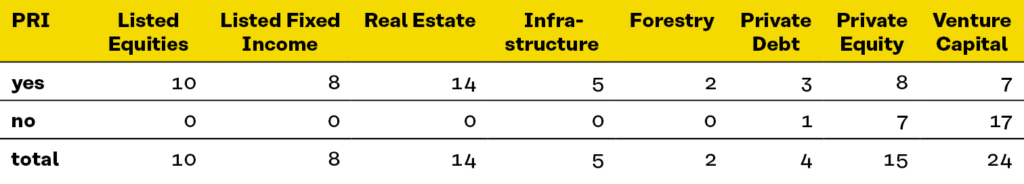

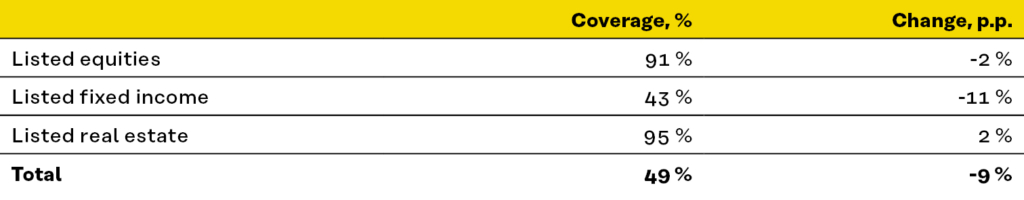

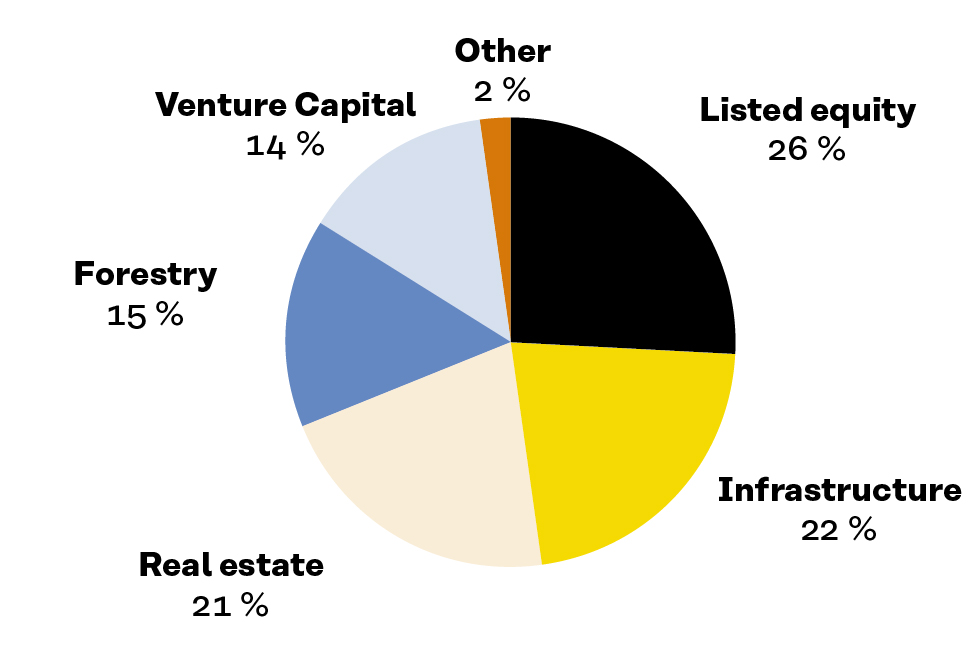

Sitra’s investments are mainly made through funds. In the case of fund investments, the investments are managed by external asset managers who make individual investment analyses and investment decisions. The minimum requirement is that the asset manager has signed the PRI or has their own responsible investment policy. All of Sitra’s asset managers who manage listed equity funds, fixed income funds, real estate funds, forest funds or infrastructure funds have signed the PRI principles. Overall, asset managers that are PRI signatories manage 91% of the total value of Sitra’s investments (figure 1).

Some of the funds managing Sitra’s assets are also involved in other initiatives aimed at implementing and promoting responsible investment. These initiatives include, among others, the following:

– GRESB (Global Real Estate Sustainability Benchmark), which is a tool and framework used for assessing the sustainability of real estate and infrastructure investments.

– BREEAM (Building Research Establishment Environmental Assessment Method), which is an environmental certificate for real estate funds.

– Net Zero Carbon Buildings Commitment, in which the signatory funds strive for carbon neutrality by 2030 in terms of energy consumption during construction and use.

Often the share of environmental certificates is higher in funds that have reached a more advanced stage in their life cycle. The carbon neutrality targets are mainly reported at the asset manager level. In fact, several of Sitra’s asset managers and all of the managers who manage listed equity funds and fixed income funds are committed, for example, to the Net Zero Asset Manager Initiative (NZAMI).

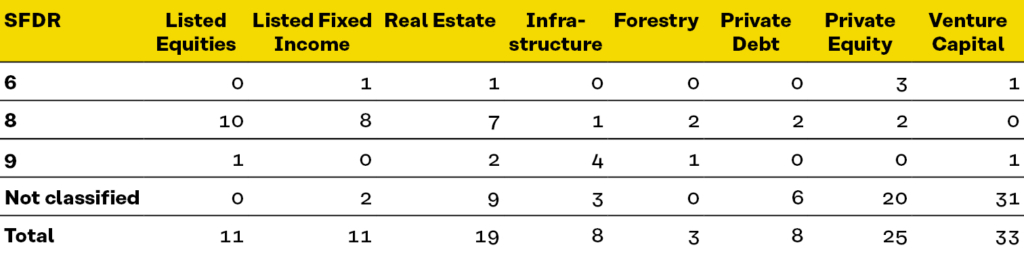

The EU Regulation on sustainability‐related disclosures in the financial services sector (Sustainable Finance Disclosure Regulation, SFDR) entered into force in 2021. It divides fund products into three categories according to their level of sustainability and obligates the fund managers to report the category of each fund. No minimum requirements have been set for Sitra’s funds in terms of SFDR. The SFDR categories of the funds are shown below, both in unit numbers and according to their market value (figures 2a and 2b).

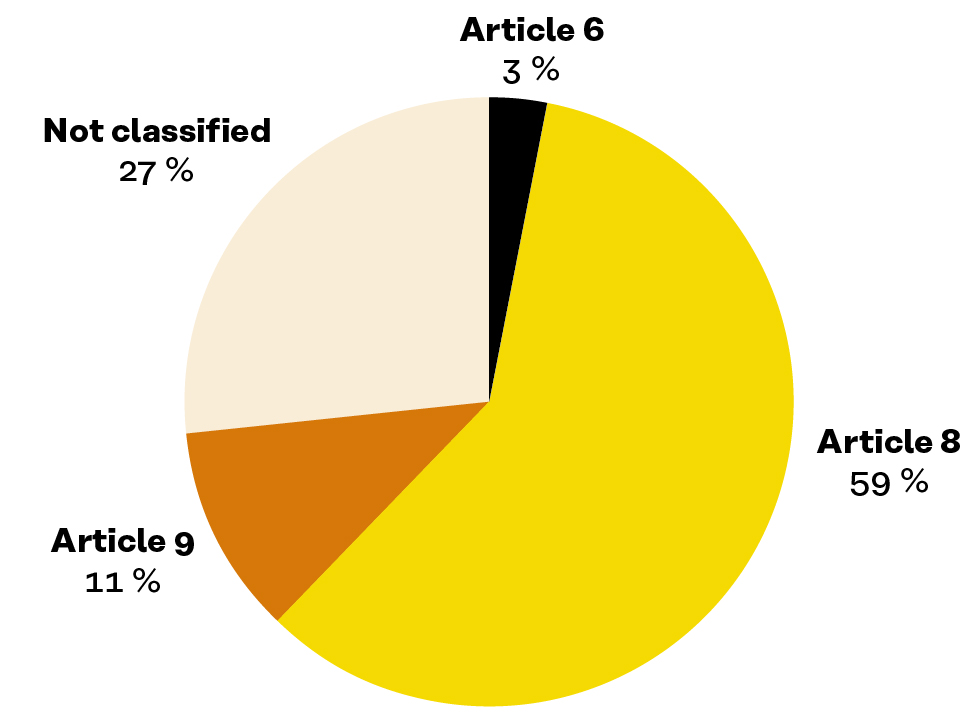

MSCI assessed the fund investments made by Sitra in 2022. As in the previous year, the entire portfolio received an AA rating. Most of the ESG rated funds selected for Sitra’s portfolio have been rated as so called ESG “leaders” (almost 70%), and 36% of the funds have received the highest AAA rating. There are no “laggards”, meaning poorly rated funds, among Sitra’s investments.

The rating method applied by MSCI was altered in spring 2023, making it more difficult for funds to achieve the best ESG ratings in the future. This will also weaken the ratings of Sitra’s fund investments in the coming years.

According to the sustainability assessment conducted by Morningstar, approximately 65% of Sitra’s funds belong to the highest category of their five-globe rating system (figure 3).

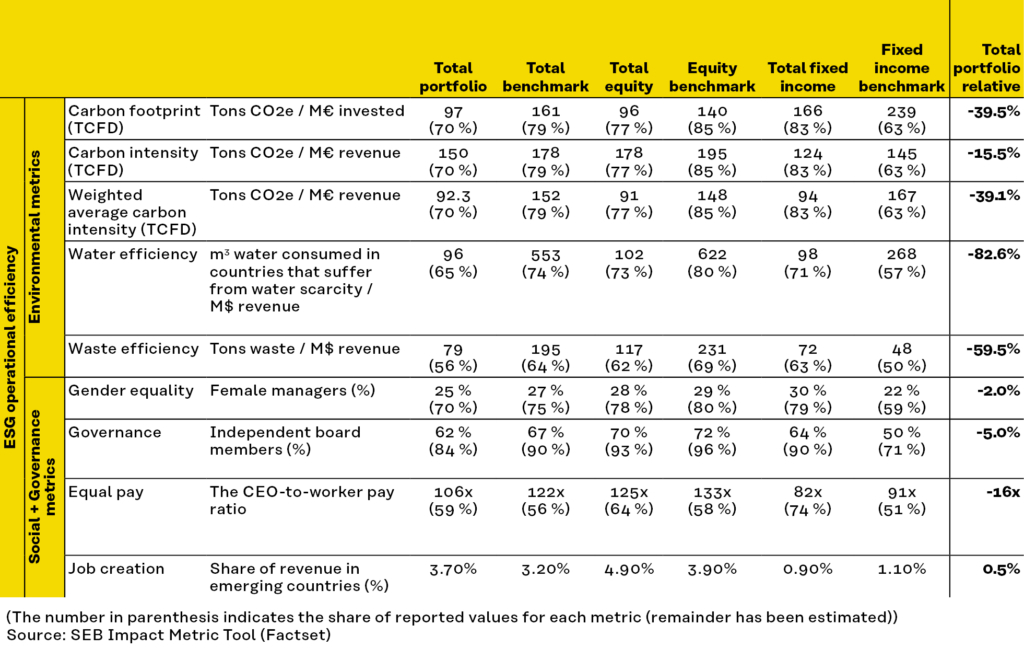

In addition to ESG ratings pertaining to the entire portfolio, we monitor key indicators related especially to the environment in accordance with our carbon neutrality target. These key indicators are described in the chapter on environmental reporting. In addition, SEB has analysed key indicators of Sitra’s portfolio in view of the environment, governance and social issues (figure 4)

According to the key indicator describing the realisation of gender equality, the companies in the portfolio perform slightly below the benchmark index. In Sitra’s investment targets, the share of female managers is 25%, while the corresponding figure for the benchmark index companies is 27%. The share of independent board members is also slightly below the index at 62% (index 67%). In contrast, pay equality and the creation of new jobs is at a better level in Sitra’s portfolio than among the benchmark group.

Engagement efforts

As a fund investor, Sitra has the opportunity to influence its investments by engaging in dialogues with asset managers. If engagement efforts do not lead to improvement, the fund in question may, as a last resort, be divested. In 2022, ESG issues were discussed in approximately 90% of the meetings held (approximately 80% in 2021).

Sitra conducts industry screenings and assesses potential violations of norms based on MSCI’s reports. The reporting covers Sitra’s listed equity funds and fixed income funds. In 2022, industry-related exclusions were carried out in all funds. Norm violations were discovered in the ownership of one fund, but the fund was already in the process of enforcing engagement efforts on the matter.

ESG matters in unlisted investments (real estate, infrastructure, private debt, PE and VC) are reviewed annually in the valuation meeting based on the reports submitted by asset managers. Any deficiencies and breaches observed in ESG matters are reported and noted in the minutes of the meeting for follow-up. No deviations from Sitra’s industry exclusions were observed. The lack of data, particularly in the private equity and venture capital asset classes, constitutes a challenge with regard to the in-depth assessment of ESG issues. The asset managers are aware of these deficiencies, and significant improvements in reporting are expected in the next few years.

Sitra’s carbon neutrality target requires continuous dialogue with asset managers because, as a fund investor, Sitra cannot influence the selection of individual investments.

In 2023, Sitra’s goal is to monitor the engagement and ownership practices of the asset managers more actively. According to 2022 reports, all of Sitra’s equity funds (including indexfunds) participated in annual general meetings or voted in general meetings by proxy. We will also be paying more attention to voting practices in the future.

Sitra has been a support member of the Climate Action 100+ project since 2020. The project encourages companies to achieve emission reduction targets in line with the Paris Agreement and to report on the risks posed by climate change to businesses. Based on an analysis conducted in autumn 2022, Sitra’s investee funds had invested in 42 companies targeted by the Climate Action 100+ initiative. We asked the asset managers of the funds in question to provide an account of the engagement efforts applied to the companies. The asset managers had aimed engagement efforts on around 30% of the companies, and the efforts varied from voting in general meetings to divesting the investment. Some used an external service provider or participated in an investor consortium. In contrast, nearly 70% of the companies were left outside any engagement efforts. Often this was due to limited ownership and, similarly, limited engagement opportunities.

PRI assessment of Sitra’s report on responsible investment

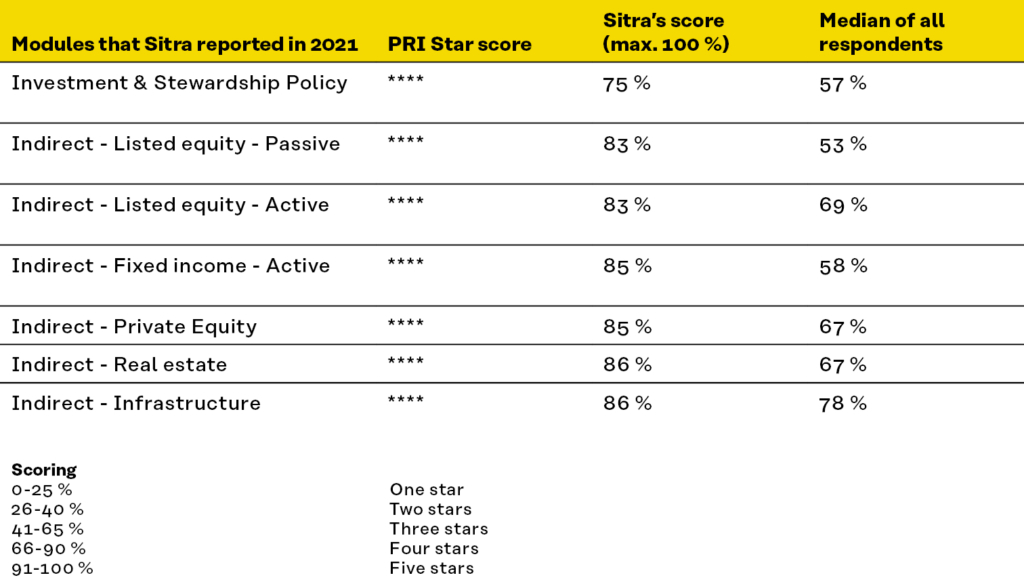

Each year, Sitra reports to the PRI (UN Principles of Responsible Investment) detailing its responsible investment practices and procedures, which are then assessed by the PRI. The PRI revised both its reporting framework and rating system in 2021, causing the 2022 assessment to be omitted completely. The next report will be issued in 2023.

According to the PRI’s new rating system, Sitra received four stars (out of a maximum of five) in all areas of the 2021 report.

The PRI reporting is a tool that enables comparing responsible investment practices with those of investment pioneers and, at the same time, developing one’s own activities. The results of Sitra’s latest PRI assessment have been utilised in the work towards updating the Guidelines for Responsible Investment.

Climate report

Introduction

Mitigating climate change is one of Sitra’s most important sustainability goals, and we support, among others, the goals of the Paris Agreement. One of Sitra’s strategic goals is related to adapting to the earth’s carrying capacity.

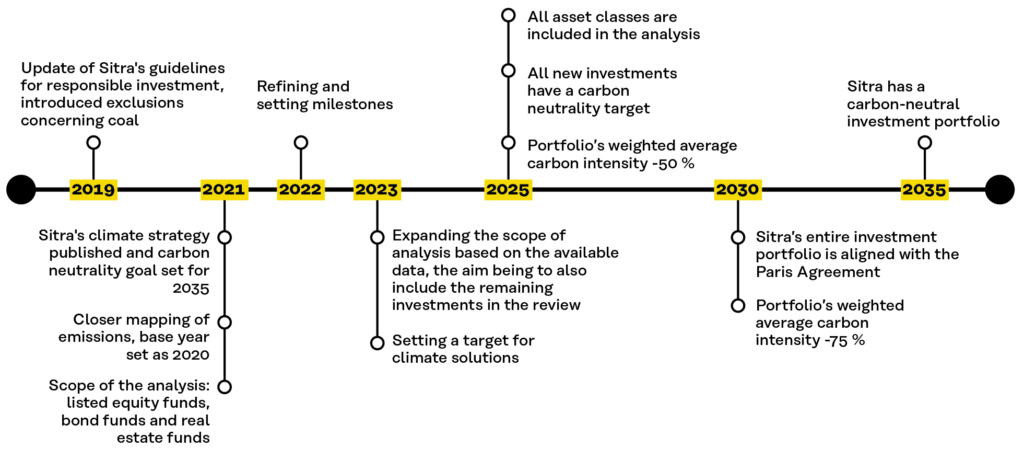

Sitra’s climate strategy for investments (LINK) was published in spring 2021, and the strategy is updated as necessary. The long-term objective is that all of Sitra’s investments are aligned with the Paris Agreement. The aim is to achieve a carbon-neutral investment portfolio by 2035 in accordance with Finland’s national target, provided that the investment environment makes it possible.

Sitra uses the international TCFD reporting recommendation and framework (Task Force on Climate-related Financial Disclosures) in the reporting and analysis of climate risks. The TCFD is an international reporting recommendation that instructs companies to report consistently on the financial risks and opportunities presented by climate change. According to the recommendation, it is important to determine the carbon footprint of investments, assess fossil fuel reserves and low- and high-carbon-emitting investments, as well as monitor the implementation of carbon emission limits in accordance with international climate agreements.

Governance

Investment matters related to climate change are prepared and implemented in accordance with the same principles as any other matters related to responsible investment Sitra’s Board of Directors approves both the Guidelines for Responsible Investment and the Climate Strategy for Investments.

Sitra’s Vice President (Investments) is responsible for the organisation of responsible investment activities at Sitra. Moreover, all individuals participating in Sitra’s investment operations are responsible for the implementation of Sitra’s responsible investment guidelines. Responsible investment topics are regularly reviewed at the investment team’s weekly meetings. Matters related to the climate strategy are addressed in close collaboration with other Sitra experts.

Investment matters related to climate change are regularly reported to Sitra’s Board of Directors. Sitra also reports annually to the PRI on its responsible investment practices.

Climate strategy

Sitra’s Board of Directors approved Sitra’s climate strategy for investments in 2021. The strategy was updated at the beginning of 2023 with regard to issues such as concrete milestones. The purpose of Sitra’s climate strategy for investments is to mitigate climate change, which is one of the primary sustainability goals in Sitra’s investment activities. The climate strategy is used for both managing climate risks related to investments and for attempting to identify future profit opportunities.

According to the TCFD definition, the risks posed by climate change are divided into transition risks related to the economic transformation and physical risks caused by global warming.

The transition risks are related to regulatory changes, technological development, market behaviour and reputation risks. The physical risks are further divided into acute and chronic risks. In turn, the profit opportunities brought about by climate change are related to, for example, companies that develop either technologies for climate change mitigation or solutions that facilitate a transition to a low-carbon economy.

Climate risks and climate opportunities have economic impacts, the identification of which may lead to changes in strategic allocation, investment strategy, potential divestments and dialogue with asset managers and enterprises. The economic impacts of the climate risks may include, for example, production-related and operational disturbances, supply chain disturbances, loss of asset values, physical damages, an increase in insurance premiums, and changes in resource and production prices and consumption behaviour.

Sitra takes climate risks into account as part of its ESG risk management work, which is an ongoing activity. Risks are identified based on data from different information sources, the most important of which is the reporting service provided by MSCI. Consequently, the identified climate risks are primarily managed through dialogue with asset managers and fund selections. Furthermore, Sitra has excluded from its investments all companies with more than 30% of their turnover linked to coal production or coal use in power generation without a clear strategy to reduce coal use.

The share of fossil fuels in Sitra’s investment portfolio is very small and well below the benchmark index. The benchmark index is a combination of indices weighted according to strategic allocation. The indices used were MSCI ACWI, MSCI Finland IMI, MSCI Emerging Markets, MSCI EUR IG Corporate Bond, MSCI EUR HY Corporate Bond and MSCI World Real Estate.

Assets that lose value due to climate change (so-called “stranded assets”) constitute less than 0.1% of Sitra’s investments. Based on the CVaR indicator (Climate Value-at-Risk) calculated by MSCI, the future economic risk on Sitra’s investment portfolio caused by climate change is moderate and well below the benchmark index.

Climate risks can also be assessed by examining the climate targets of the investee companies and how they align with the goals of the Paris Agreement. At the end of 2022, almost half of Sitra’s liquid investment assets were invested through funds in companies that are either on or below the so-called two-degree path.

Time span and coverage of the strategy

Sitra’s climate strategy is divided into milestones, and it will be specified further as more ESG data becomes available.

Currently, the monitoring and targets cover the listed equity funds, fixed income funds and real estate funds. For these asset classes, the availability of data is moderate. However, there is little (comparable) data on non-liquid asset classes. In the coming years, the monitoring will expand to other asset classes as the data coverage increases.

In terms of Sitra’s listed equity investments and real estate investments, the data coverage for carbon footprint and other climate-related issues is over 90%, whereas it is only slightly over 40% in the listed fixed income investments. The change compared to the previous year was negative with the exception of listed real estate investments. One cause for this negative development was increase of unlisted issuers in the fixed income funds. Moreover, the coverage rate of all investments, including non-liquid investments, also decreased significantly, as the market value of Sitra’s listed investments sank significantly more in 2022 than that of the non-liquid investments.

Scenario analyses

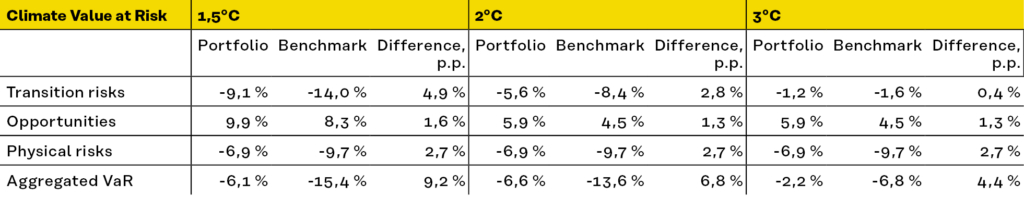

Scenario analyses examine the economic impacts of climate change with the help of the CVaR (Climate Value-at-Risk) indicator and the warming effect of the investment portfolio with the help of the ITR (Implied Temperature Rise) indicator. Both indicators are calculated by MSCI.

Climate Value-at-Risk (CVaR) is a key indicator that describes the transition risks and opportunities as well as the physical risks and opportunities associated with investments over an extensive time span. The percentage describes a potential positive or negative value change in investments caused by climate change. The percentage may vary from negative 100% to positive 100%. The impact of transition and physical risks is usually negative, whereas the impact of opportunities is positive. Together, they form an overall impact.

There are three different warming scenarios to be considered, i.e. 1.5 degrees (℃), two degrees and three degrees. The selected scenarios affect the rating of transition risks and opportunities, but MSCI uses a single standard model based on a higher warming scenario to assess the physical risks. Therefore, the impact of physical risks remains unchanged in all scenarios.

In all scenarios, the risks and opportunities associated with Sitra’s investments outperform the benchmark index. The overall impact is at its highest in the two-degree scenario, in which the negative impact on the value of investments would be around 7%. In the three-degree scenario, the economic impact on the value of investments would be lower due to reduced transition risks.

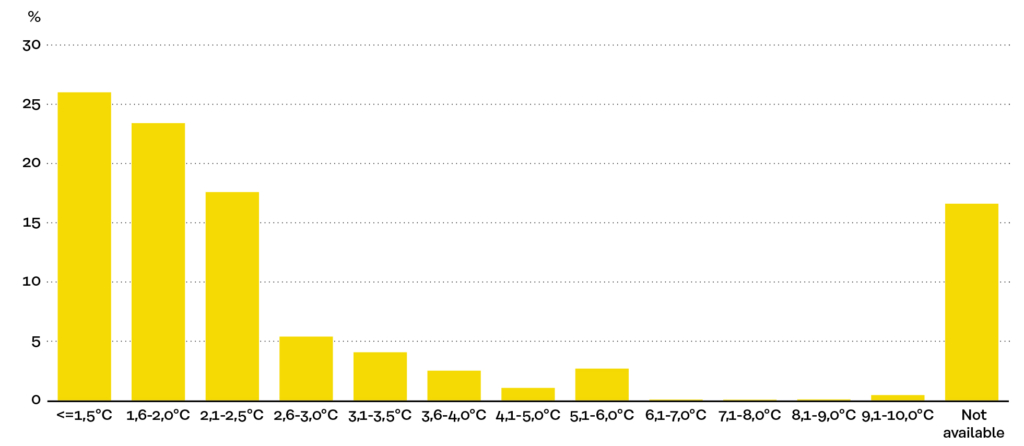

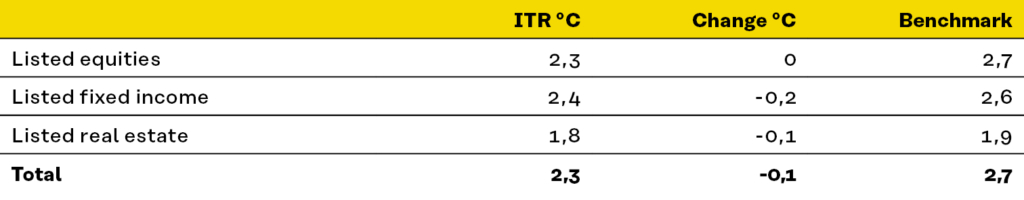

The Implied Temperature Rise (ITR) indicator describes how well the companies in Sitra’s investee funds are aligned with global climate targets. It compares the companies’ absolute emissions and emission reduction targets with their emission budgets as set by the IPCC. All company-specific data is aggregated at the fund and portfolio level. The analysis covers liquid investment objects, i.e. listed equity funds, fixed income funds and real estate funds.

Based on the analysis, all of Sitra’s liquid investments suggest a warming scenario of 2.3 degrees. The indicator dropped by 0.1 degrees from the previous year and is 0.4 degrees lower than the benchmark index. However, Sitra’s investment portfolio is not yet in its entirety in line with the goals of the Paris Agreement. At the moment, only the portfolio of listed real estate investments hits under the two-degree target.

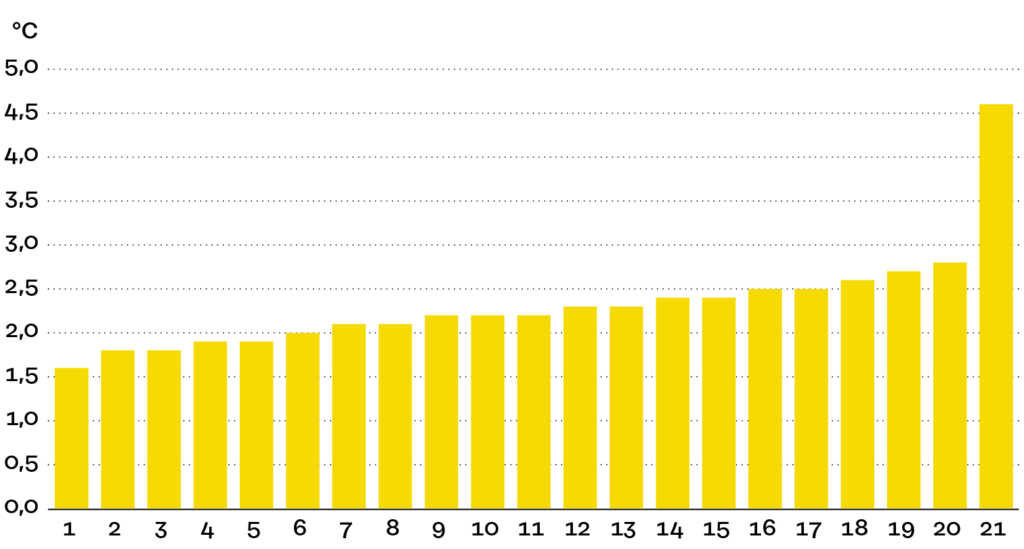

The figure below shows the ITR ratings of the liquid funds according to the result. The indicator can be calculated for 21 funds, which account for 57% of the market value of Sitra’s entire investment portfolio.

None of the funds are yet in line with the warming scenario of 1.5 degrees, but five funds are below the two-degree target.

Objectives and indicators

Sitra’s long-term objective is that all our investments will be in line with the Paris Agreement. Furthermore, Sitra aims to achieve a carbon-neutral investment portfolio by 2035 in accordance with Finland’s national target, provided that the investment market makes it possible.

The climate impacts and climate risk associated with Sitra’s investments are primarily measured based on their carbon footprint. Currently, the most important indicator is weighted carbon intensity, which measures the carbon-equivalent emissions of investees relative to their turnover and weighted by the market value of the investments.

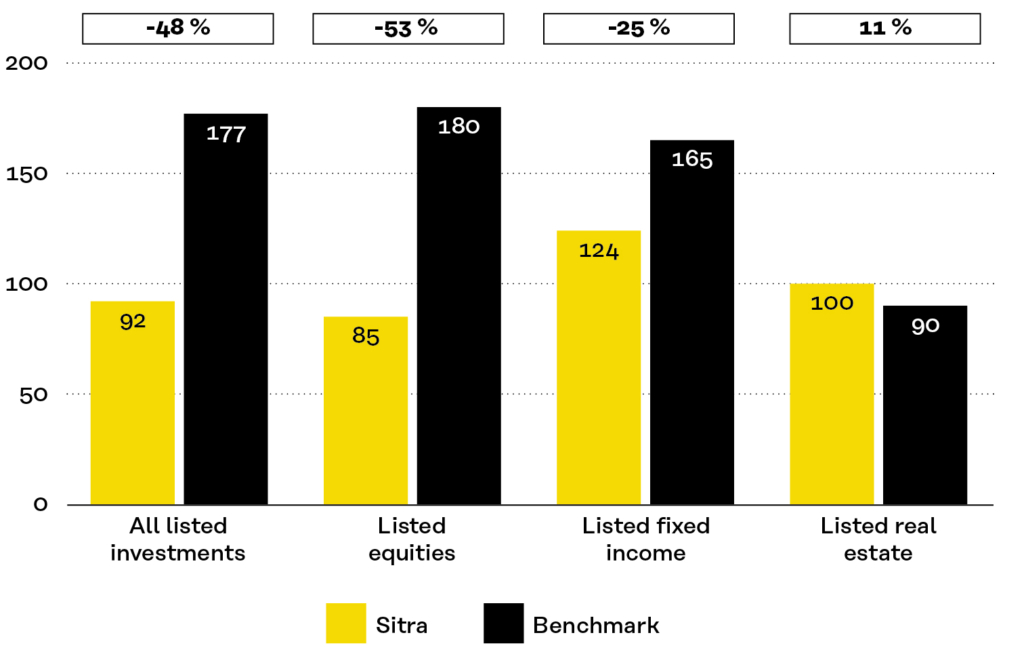

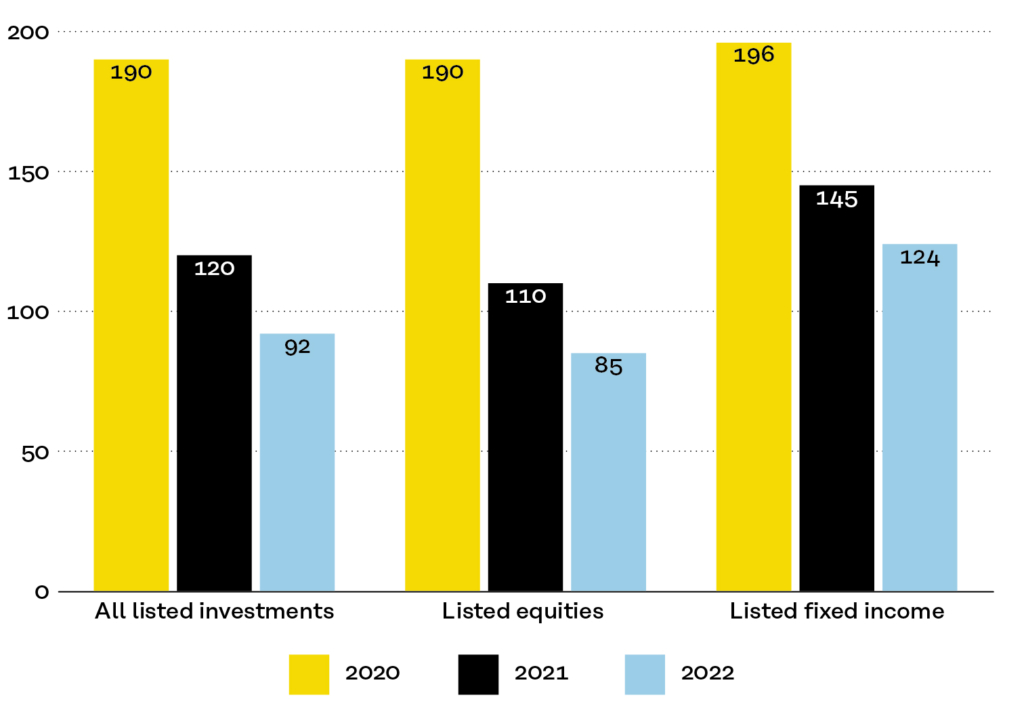

In the short term, Sitra’s aims to significantly reduce the carbon intensity of its investment portfolio and to remain below the benchmark index. The progress will be monitored in relation to the benchmark index as applicable. The goal is to ensure that the carbon intensity of Sitra’s investments is at least 50% lower in 2025 than in the reference year 2020. The corresponding target for 2030 is 75%.

When examining the carbon footprint and carbon intensity, account will be taken of emissions arising directly from a company’s own operations (scope 1) and indirect emissions related to the use of purchased energy (scope 2). Indirect emissions (scope 3) are also reported, but no reduction targets have yet been set for them due to uncertainties relating to data reliability.

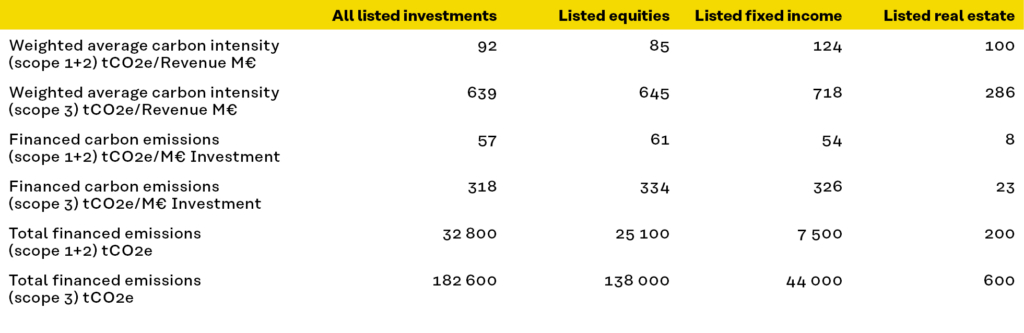

Figure 12 describes the central carbon indicators for Sitra’s investment portfolio in late 2022. At the end of 2022, the weighted carbon intensity of all of Sitra’s liquid investments was 92 tCO2e/M€ revenue. The weighted carbon intensity of equity investments was 85, while that of fixed income investments was 124. Absolute emissions can be calculated for ca. 60% of the portfolio’s total value but these figures still involve significant amount of uncertainty.

The carbon risk of Sitra’s investments is compared with a benchmark index that consists of equity and fixed income indices weighted according to the relative shares of the corresponding funds in Sitra’s portfolio. The carbon risk of all of Sitra’s listed investments was nearly 50% lower than that of the benchmark index, and the risk was more than 50% lower for listed equity investments. This difference is attributable to exclusions, the selection of responsible asset managers and the fact that Sitra’s equity investments are focused on growth stocks.

The carbon risk of Sitra’s listed real estate investments was slightly higher than that of the benchmark index. This is due to the merger of the REIT fund into a larger global fund in 2021.

The development of the weighted average carbon intensity remained positive in 2022. The carbon intensity of all listed investments, as well as that of equity investments, decreased by 22%. The decrease was 14% for listed fixed income investments and 19% for listed real estate funds. Compared to 2020, the weighted carbon intensity has already decreased by more than 50%, meaning that the milestone set for 2025 was met well ahead of schedule.

Funding to climate solutions

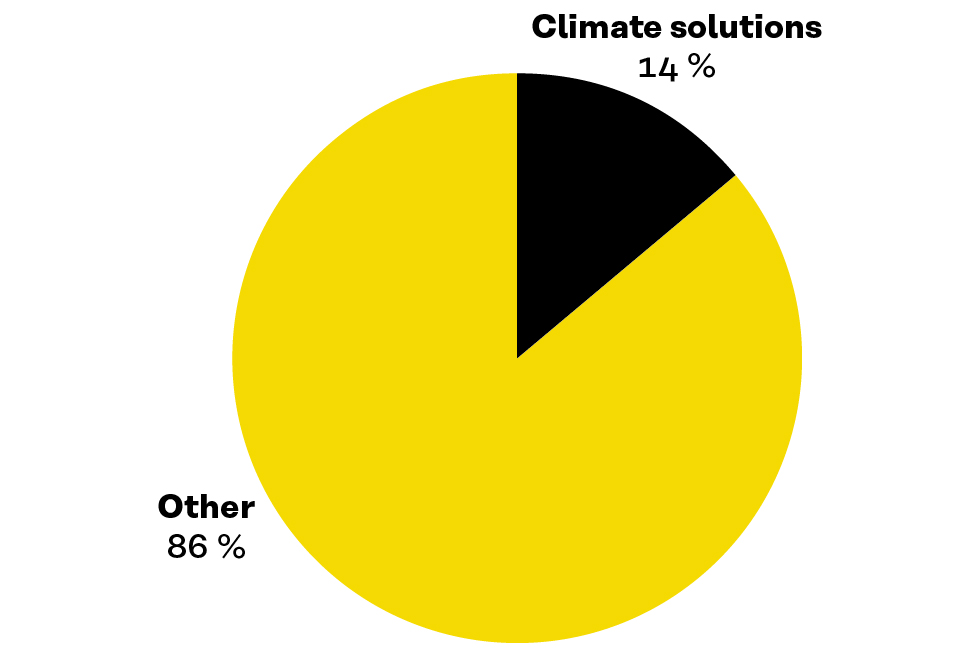

One important tool in mitigating climate change is funding so-called climate solutions. Climate solutions refer to investing in targets which produce solutions enabling emission reductions and take the progress of climate change into account in their activities. As of yet, there is no unambiguous definition for climate solutions, which is why no target has yet been set for them.

The very first assessment of the share of climate solutions was carried out based on 2022 holdings. In terms of liquid investments, MSCI issued a report on the share of the so-called green revenue in the turnover of companies weighted by the market value of the investment. In addition, Sitra assessed the distribution of non-liquid investments between climate solutions and other investments based on the share of climate solutions in the company’s turnover and weighted by the market value of the investment. Based on the assessment, climate solutions accounted for 14% of the total investment portfolio.

The number of climate solutions increased especially due to infrastructure investments in renewable energy, sustainable forest investments, certified real estate investments and venture capital investments in companies developing climate solutions. When measured by market value, climate solutions are mostly found in listed equity investments, which is clearly the largest asset category in Sitra’s investment portfolio.

Biodiversity

Biodiversity is Sitra’s next focus area for responsible investment. Similar to climate risks, biodiversity loss can also affect investment portfolios regardless of asset type, industry and geographical location.

Sitra has gained insight on how to account for biodiversity in investment activities by, for example, discussing the topic with other investors and stakeholder as well as our own specialists. The first step is to explore the different approaches applied by investors to biodiversity issues. We also carried out the first biodiversity analysis on Sitra’s portfolio. It helped us to identify the areas that are most dependent on biodiversity and those that have the greatest impact on it. This type of data enables us to set new goals and develop our operations.

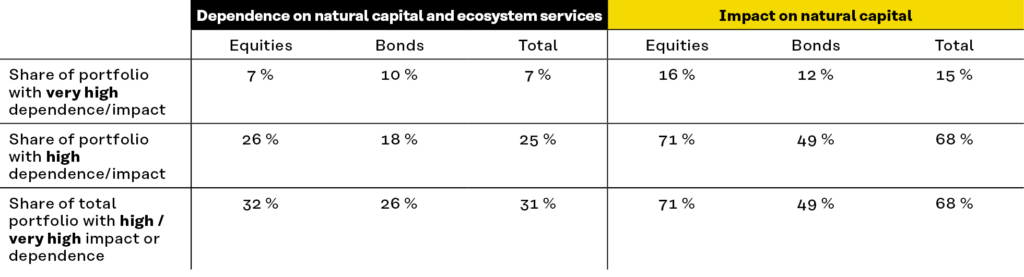

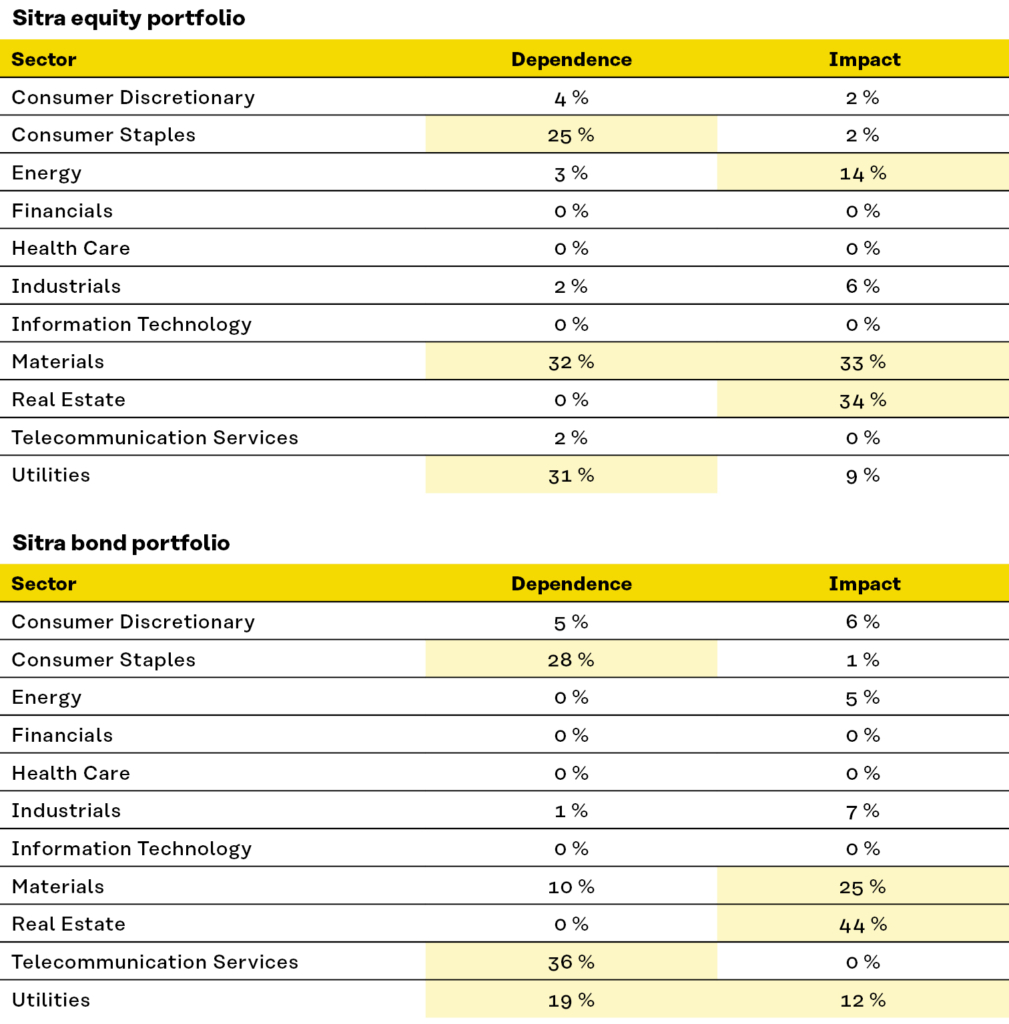

The very first biodiversity analysis was carried out on Sitra’s listed portfolio, including equity funds, fixed income funds and real estate funds. The analysis covered 59% of all Sitra investments.

The review of biodiversity impacts and dependencies was carried out by SEB using the so-called ENCORE tool (Exploring Natural Capital Opportunities, Risks and Exposure). ENCORE is a free tool developed by the UNEP Finance Initiative (UNEP FI) and its partners (https://encore.naturalcapital.finance/en), aimed at helping companies understand their dependencies and impact on nature.

In terms of the equity funds in Sitra’s portfolio, one third of the companies are strongly dependent on biodiversity and natural capital, and around 70% of the companies have a significant impact on biodiversity. With regard to the fixed income portfolio, approximately one quarter of the companies are heavily dependent on biodiversity, and around half of them have a substantial impact on it. Water resources constituted the most significant natural capital item, on which all of the companies were dependent. From the viewpoint of the companies’ own impacts, almost all natural capital items were equally significant.

In the equity portfolio, the industries with the most substantial dependency on natural capital included materials, utilities and consumer staples. Similarly, the material production and real estate sectors had the most significant impact on natural capital.

With regard to fixed income investments, the dependency was greatest in the fields of telecommunications services and consumer staples. The industry with the greatest impact on nature was the real estate sector.

The ENCORE method helps to identify sectors and activities that are most likely associated with high risks and significant impacts on nature. In contrast, the method does not include any data on economic risks, geographical weightings or individual companies’ efforts to manage natural risks. However, the analysis can still be used to identify sectors which should be subjected to measures such as engagement efforts and further investigations.

In addition to the industry analysis related to biodiversity, we examined our asset managers’ reporting activities on the matter. About one fifth of our funds had taken biodiversity issues into account. The matters were most often discussed among real assets, such as forest and real estate investments. This is logical, as these are essential sectors for biodiversity. According to the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), changes in land and sea use, direct use of natural resources, pollution and alien species are, in addition to climate change, key causes of biodiversity loss. In terms of real estate, biodiversity can be promoted in the built environment through measures such as garden planning. For example, one of our asset managers has reportedly engaged in various measures, such as diversifying the range of plant species, adding plants for pollinators, and converting grass fields into meadows and dynamic planting areas. In terms of forest funds, biodiversity can be promoted, for example, by increasing the mix of different tree species.

Disclaimer: Although Sitra’s information providers, including without limitation, MSCI ESG Research LLC and its affiliates (the ”ESG Parties”), obtain information (the ”Information”) from sources they consider reliable, none of the ESG parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for, or a component of, any financial instruments or products or indices. Further, none of the Information can in and of itself be used to determine which securities to buy or sell or when to buy or sell them. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.