Taking responsibility-related aspects into consideration and reporting on them are an increasingly significant part of financial practice.

The institutional and private customers of financial market operators want their assets to be invested and managed in accordance with responsible principles. Responsible investing is no longer a marginal phenomenon.

Responsible investing refers to taking environmental, social and governance factors into consideration without compromising the yield of the portfolio. There is no single correct way of investing responsibly; each investor chooses the tools that suit their own investment strategy.

In fact, many investors and financial market parties have developed their responsible investment policies in recent years, including Sitra.

In autumn 2018, Sitra sent out an ESG survey to all of the portfolio managers administering its funds. The survey included more than 40 questions on responsible investing and on the emphasis placed on ESG factors. They included both open and closed questions.

The aim of the survey was to gain an overview of the responsibility of the funds. Moreover, the results can be referred to in talks with the portfolio managers.

Good attitudes towards responsibility; varying practices

The survey indicated that almost all funds implement responsible investing in some form, and the attitude towards it is good. Training in responsible investment, however, is not an established practice at some of the funds. In addition, only around half of the funds have set specific responsibility objectives.

The majority of funds have also influenced the responsibility practices of their investments. Share, equity and fixed-income funds in particular stress that active ownership is one of the best ways of influencing the ESG factors of an investment.

Above all, responsible investing, and identifying and monitoring the ESG factors of the investments, are a risk-management method for the funds. The aim of monitoring the ESG factors is to avoid risking the value of the investment.

Correspondingly, monitoring ESG factors can lead to business opportunities by identifying which ESG factors could benefit the company financially. Except for one fund, preparing ESG analyses is an established part of the operation of the funds.

Sounds simple.

Shared standards

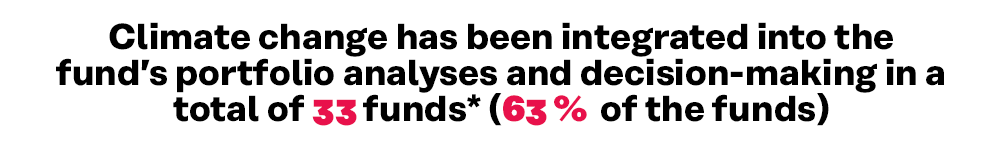

While a broader picture can be formed by an overall analysis of the ESG survey, the diversity of the responses from the funds was considerable. While some responded to questions on issues such as integrating climate change into their processes with just a single word, others offered hundreds of words of detailed information in response.

Understanding what underlies the brief answers is left up to the reader. Narrowing down the room for interpretation would be an obvious goal for any future responsibility surveys from Sitra.

The diversity of the responses can be attributed to the fact that the funds that responded to the survey work within different asset categories (shares, fixed income, equity, real estate, private debt) and vary in size. These factors affect the available ways of influencing the fund and the amount of resources available for responsibility-related work.

The fact that there is no internationally recognised standard for preparing responsibility classifications and analyses is also not insignificant. Therefore, each fund has different ESG data available, even though some of them naturally use the same service provider for collecting responsibility information.

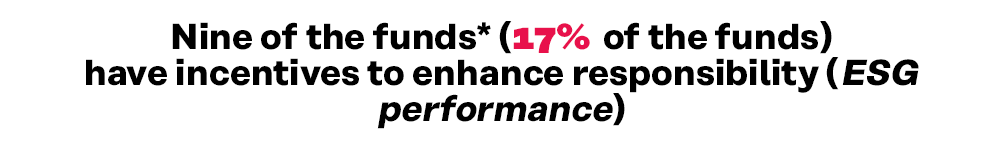

For instance, the TCFD (Task Force on Climate-Related Financial Disclosure) provides a commonly accepted reporting standard with which businesses can report on the risks and opportunities caused by climate change to their business operations. However, only nine of Sitra’s funds, or 17% of all respondent funds, used it in their reporting.

EU’s legislation package on sustainable finance will result in changes

In addition to the diversity of the responses, the performance of theme funds drew attention. A “theme fund” refers to a fund that invests in a responsibility-related theme, such as the sustainable use of energy. Investments are only made in selected industries.

Based on the survey, some of the theme funds that responded to the survey were not particularly responsible. Some, on the other hand, performed exceptionally well.

Theme funds do not necessarily have formal training in responsible investing or have specified responsibility goals. These lower the ESG score of the fund.

The fund can nevertheless select its investments based on very strict responsibility criteria. Also, even though some funds do not admit to having formal training programmes in responsibility surveys, the fund’s portfolio managers can be professionals in ESG analysis.

Measuring responsibility is therefore not black and white.

Comparing the responses would be easier if the investor knew that everyone followed similar standards in their responsibility reports.

Perhaps this will change in the future, as the European Union is preparing a legislation package on responsible finance. For the first time, the biggest financial institutions will be forced to report on the environmental impacts of their operations and financial products or provide an explanation for not taking sustainability impacts into consideration.

The European Parliament and Council have already approved some of the regulations to be included in the regulatory package, but they will primarily become applicable during 2020.

Responsibility analysis = financial analysis?

One of the funds reported that it does not have responsibility goals because it is not a socially responsible investment fund (SRI fund). Comments such as this might become even rarer in the future, with responsible funds becoming just “funds”.

”Responsibility analyses are made to identify the factors that influence the value of the investment.”

The survey showed that responsibility analyses are already an important part of the analysis of potential investments for many funds. They are used to identify relevant factors that influence the value of the investment. Responsibility analyses are rapidly becoming equal to financial analyses.

Based on the survey, the conventional funds that responded extensively use diverse methods of responsible investment, such as active ownership and positive screening. Drawing a line between responsible and conventional funds therefore seems somewhat artificial.

Looking simply for a word referring to an ESG factor in the fund’s name gives a limited view of the responsibility of the fund.

It is essential that funds recognise their own influence in the same way as institutional investors. Pressure from investors on businesses can have a significant impact on the kind of responsibility principles adopted by businesses.

*A total of 53 funds responded to the survey (equity funds N=12, fixed-income funds N=8, venture-capital funds N=19, real-estate funds N=10 and private-debt funds N=4). The respondents manage 91% of the market value of Sitra’s investments. The respondents included 13 funds managing assets of less than EUR 100 million and 33 funds managing assets ranging from EUR 100 million to EUR 1 billion. In addition, there were six funds that manage assets of over EUR 1 billion.

The author, Minna Hemmilä, works in Sitra’s communications team and is writing her master’s thesis on responsible investment for Tampere University alongside her job. Sitra’s ESG survey is used in the thesis. This article was written based on an analysis of the ESG survey.

Recommended

Have some more.