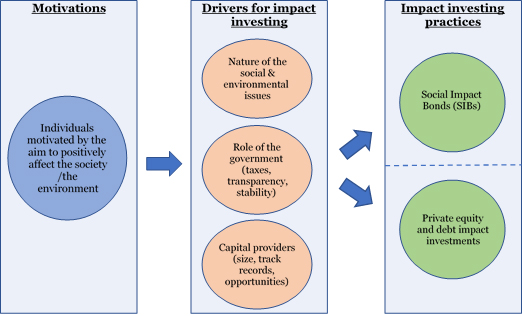

Over the last decade, both public and private entities have begun to realise the need to come up with innovative financial models that can address today’s most pressing issues. However, the strong enthusiasm around impact practices has also led to several ambiguities. To address some of these, a study comprising 18 impact investors from India and Finland examined the influence of the external environment on impact investors’ practices.

The purpose of the research was to analyse if the drivers for impact investments differ between developed and developing countries. And, if there is a difference, is it caused by 1) impact investors and their own motivation; 2) the distinct impact investing markets and the incentive structures they provide; or 3) both of these?

Different practices

The findings of the study indicate clearly that impact investing markets and practices differ between countries.

In an emerging country such as India, the market is heavily dominated by private equity and debt impact investments. Impact investors typically operate in mainstream funds that infuse impact capital only. Furthermore, because of the enormous size of the Indian population and the long history of the Indian financial markets, these companies operate in a broad range of sectors and do not focus on specific themes.

In a developed country such as Finland, the impact investing scene is very different. More complicated and specific instruments have been developed, such as social impact bonds (SIBs). While they can address specific issues and can be built for any purpose, they also have downsides, such as the fact that they require full commitment from the different parties and strong impact measurement structures. Moreover, because of the specificity of the structure of SIBs, impact investing is often only part of an organisation’s activities.

Same motivation

Overall, impact investors are all motivated by personal values that focus on positive societal changes. Obviously, if impact investors were not motivated by ethical values, they would focus on traditional investments and on maximising financial returns only.

However, although some claim that impact investors can be grouped into two categories –impact first and finance first – it seems that this is mostly determined by the profile of the company in which the investor operates, and not by his/her personal values.

In both Finland and India, impact investors greatly enjoy operating in an innovative sector that has yet to be fully discovered and that requires combining several skill sets (such as financial analysis or a strategic advisory). It could be argued that in Finland, because impact investments are typically only part of an organisation’s activities, the motivation is less profound and more superficial than in India. Nevertheless, such a claim has to be taken lightly since impact washing practices seem to be easier and more frequent in emerging countries than in developed ones.

Different drivers

In contrast with impact investors’ motivations, the specificities of the external environment significantly influence the way impact investors operate, which is why impact investing practices differ between emerging and developed markets. Furthermore, knowing that impact investing is often seen as a marriage between public and private sectors, governments and other public entities clearly affect how impact capital is deployed.

The results highlighted that in an overpopulated country such as India, problems are too numerous for the government to take care of them all. This, together with the long history of the Indian financial market and the large amount of foreign capital available, has strongly incentivised social entrepreneurs to step in (and indirectly affect investors). Moreover, because government initiatives are still completely input-based, there is no room for developing output-based instruments such as SIBs.

By contrast, it seems that in Finland society has found additional value in other kinds of instruments (SIBs) that allow complex, indirect and long-term issues affecting social welfare to be addressed.

The results also indicate that SIBs are the best way for the private sector to ensure that tax money is spent efficiently and for useful purposes. In other words, high tax rates and a lack of fiscal incentives prevent entrepreneurs from trying to address complex issues by themselves. Finally, because the Finnish capital market is relatively young and there is a limited number of institutional investors, it seems to be especially challenging to raise capital for an impact fund.

Summary

The results demonstrated a clear positive relationship between the maturity of a country’s impact investing market and the involvement of its government. While impact investors’ motivations determine who is engaged in the industry, market-based incentives, and government initiatives in particular, dictate the direction that the market takes as well as the way actors operate.

In other words, the answer to the question of why drivers for impact investors differ between markets can be found in a similar way to the answer to the question of why impact investing markets differ between countries. SIBs and private equity impact investments are not only different instruments, but also require different market structures and develop distinctly from one another.

Sitra’s guest blogs give a voice to the players of the future in different fields. They do not (necessarily) directly link to Sitra’s work or agenda, but are the authors’ thoughts on current issues that relate to the themes Sitra is passioned about.

Further reading!

Robin Kipfer

Master’s Thesis:

What Drives Impact Investors?

A Comparison between a Developed and a Developing Country

Department of Management and Organisation

Hanken School of Economics

Helsinki 2019

Recommended

Have some more.