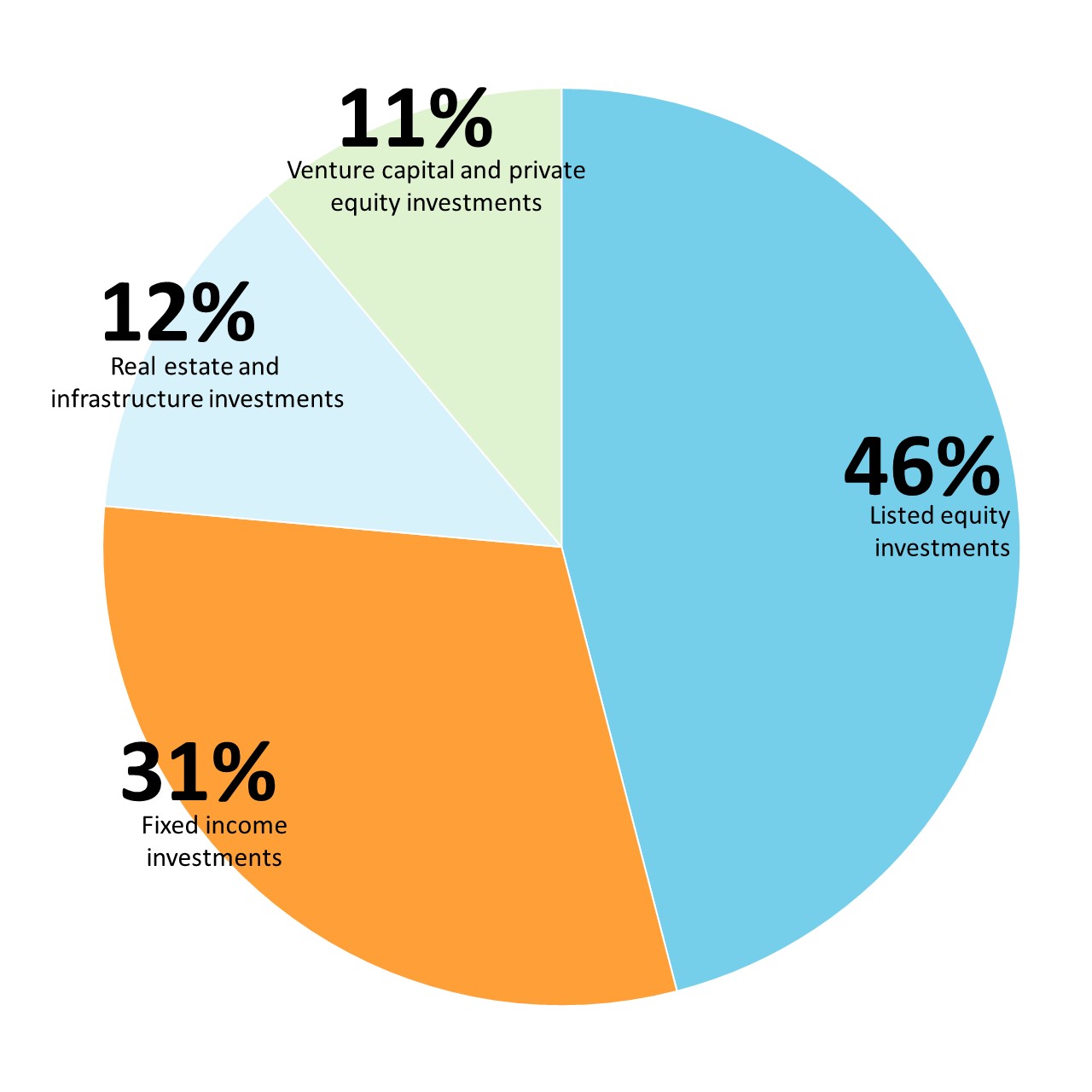

The market value of Sitra’s investment assets was 976 million euros on 31 December 2020 (942 million euros on 31 Dec. 2019). In 2020, the return on investments was 11.0 per cent. Sitra’s listed equities generated a return of 17.9 per cent, fixed-income instruments 2.2 per cent and other investments 10.2 per cent. The five-year average annual return was 7.4 per cent.

The first payment of 33.3 million euros to further capitalize Finnish universities was made at the end of August. In December 2019 Sitra’s Supervisory Board decided to make a non-recurring donation of 100 million euros to universities. The payments will be made gradually over three years.

At the year-end many stock and fixed income markets were at their all-time highs even though the year was characterized by the worst global pandemic for a century, extensive lockdowns in major economies, 20 to 50 per cent crash in stock indices in March, negative economic growth rate and unparalleled increase in unemployment rates.

Figure 1. Sitra’s investments by asset type on 31 December 2020

The investment portfolio is diversified across geographies as well as asset classes. Over one third of investments are in Finland.

Sitra’s long-term return target is 4 per cent p.a.

Recommended

Have some more.