Investments in circular economy solutions can drive innovations that have the potential to transform whole societies. Circular economy investment opportunities can be found across all sectors, and according to the Ellen MacArthur Foundation, the circular economy delivers a massive economic growth potential, estimated at 1.8 trillion euros a year in Europe alone.

In Africa, most jobs related to sustainable material use, such as collection and recycling, are taken care of by the informal sector. As in most low and lower middle-income countries, women are more exposed to informal employment and hence more often found in vulnerable situations. The circular transition can create new green and safe jobs that are likely to be better paid and more stable, but they also require more education and skills than the informal sector can offer. Thus, investment in circular businesses also enables an inclusive development approach that creates opportunities for marginalised people such as the youth and women.

However, even if circular solutions are good for the environment and economy, many companies face challenges attracting investments for circular business models. Access to finance remains a barrier, especially for small businesses in the circular economy and for businesses in general, in part due to high interest rates. Due to collateral requirements and cultural reasons, this barrier tends to be even higher for women- and youth-owned enterprises.

Investors and banks are a heterogenous group

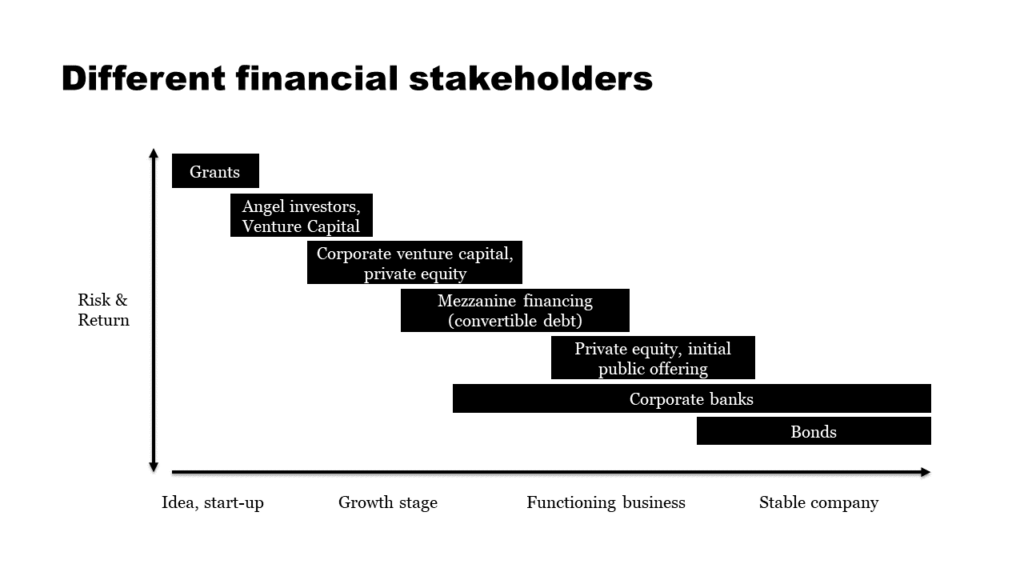

When speaking about banks and investors, it’s important to keep in mind that this encompasses a varied group of organisations. We cannot just refer to them as one group, as there are financial stakeholders with fundamentally different characteristics. However, if this jigsaw puzzle is set up right, these different organisations can form a powerful financial ecosystem.

Financial stakeholders can broadly be grouped into how much risk they are willing to bear and how much reward they expect. An angel investor or venture capitalist takes an enormous risk with each investment, but if the investments are successful, they will be generously compensated. In contrast, a corporate bank typically takes far less risk and is thus compensated less in returns.

What does this imply? Consider for example a hypothetical circular economy start-up which is still at pre-revenue stage. Such an enterprise likely cannot access conventional bank lending or entice private equity investors’ interest, as the company does not fit into these financial actors’ risk appetite. This start-up must gain access, for example, to venture capitalists and angel investors, which can help the company to scale up its operations. As the company grows and becomes profitable, it can gain access to various types of debt or equity. And once this hypothetical circular economy start-up is financially solid, it could also gain access to corporate banks.

A functioning financial ecosystem doesn’t let the ball drop

This example illustrates how a functioning financial ecosystem helps scale circular economy start-ups in Africa.

Different types of financial stakeholders are needed to form an ecosystem, whereby circular economy companies at different growth stages can access appropriate types of financing. If one stakeholder is missing companies face a bottleneck in growth.

Therefore, a functioning financial ecosystem “does not let the ball drop”, and companies can systematically access different types of financing depending on their needs and company size. As most companies in the circular economy are start-ups and SMEs (small and medium-sized enterprises), innovative solutions to improve access to private sector financing and to make sure the ball does not drop are crucial, especially for growth stage ventures.

Grants important for taking the first steps and kick-starting projects

The challenge of many circular economy start-ups, especially on the African continent, is how to climb on the first step of the financing ladder. In other words, how to develop a bankable business that attracts venture capitalists and get the capital or early-stage financing required for the commercialisation of new innovative business models and technologies. External technical assistance and advice are often also needed at this stage.

Development banks and other institutions can come in with grant financing to help young companies reach the required maturity for angel investors and venture capital. Such grant financing combined with technical assistance has the potential of multiplying the number of initiatives that get off the ground. One possible source for such grants can be the Africa Circular Economy Facility (ACEF), the newest instrument of the African Development Bank (AfDB) to support the circular economy. ACEF is a Multi-Donor Trust Fund that channels finance to innovative circular economy business models and helps entrepreneurs to mitigate the financial risk of early-stage entrepreneurship.

The Africa Circular Economy Facility (ACEF) channels finance to innovative circular economy business models.

Developing standards to facilitate evaluation of risk-premiums A study by the Ellen MacArthur Foundation and Bocconi University has found that the more circular a company is, the lower its risk of default on debt. But still the risk premiums for circular businesses are disproportionally high. As the circular economy is still misunderstood and lacks common metrics, the lower risk is not yet fully considered in evaluations.

By developing commonly agreed standards and KPIs (key performance indicators), circular investments can be promoted. Chatham House is developing such standards, in participation with AfDB and other relevant stakeholders.

Lowering risk will attract more funding

Development banks can oil the wheels of the financing sector and turn more financing flows towards circular businesses also by de-risking and building trust in the market. For instance, this can be done through concessional loans, guarantee mechanisms and improving transparency with accurate risk assessments and data. This can then attract private funding.

Many mature companies also want to transform their traditional businesses to circular. Development finance institutions and the public sector can help lower their risk of investing their own capital in circular solutions by providing blended finance and relaxed requirements for transitional initiatives to a circular economy. ACEF’s aims to also back mature businesses in their circular transition and assist their workers in scaling up their skills and competences needed.

Removing policy barriers to foster investment

One prerequisite for investments to be able to drive the circular transformation is that countries develop and enforce supportive policies. Long-term investment decisions require predictable and reliable national and regional policy frameworks and political environments. Without robust policy frameworks risks related to the operating environment rise and investment flows will be blocked.

Interested? Read more in our article series.

Another important area to foster investment in the circular economy is trade policy, for instance rules on trade of second-hand materials. One role of the development institutions can be to carry some of the risks related to the operating environment and provide guarantees in case country-related risks materialise.

Another way is to support policy work on national and regional levels. For scalability of circular businesses, harmonisation of policy frameworks on the regional level is a key enabler. The African Circular Economy Alliance (ACEA) exchanges best practices and joint initiatives.

Investing in circular infrastructure to attract private sector players

Poor infrastructure can still make it expensive for businesses to operate, increasing risk and lowering return. Public sector authorities can attract investments by enhancing the operating environment for circular businesses, such as shared development of infrastructure. The circular transition requires investment, but by creating the right local frameworks we will encourage private and public funding into circular solutions. This will improve our economy and sustainability as we build a better society for our future.

What is this about?

This article is part of a series addressing topics relevant to the circular economy and Africa. These topics will be discussed at the World Circular Economy Forum 2022 in Kigali, Rwanda.